🏙️ Welcome to Y’all Street – How Goldman, JP Morgan, & Texas Built Wall Street 2.0

North Texas’ New Financial Corridor Is Open for Business

The Street has moved — and it’s wearing boots.

If you’ve driven through Victory Park Dallas, you’ve probably noticed something new on the skyline — a gleaming Goldman Sachs Dallas campus that looks like someone air-dropped Wall Street into Uptown. Drive 25 miles north to Plano Texas, and you’ll find JP Morgan Chase’s Legacy West corporate campus — 6,000 employees strong, complete with soccer fields, walking trails, and a cafeteria that could moonlight as a Whole Foods.

Together, these two legacy institutions aren’t just expanding — they’re building Wall Street 2.0 in North Texas, and they’ve chosen the Dallas-Fort Worth financial corridor as the next trading floor of American finance. Around here, we call it Y’all Street.

Why Here, Why Now

Let’s be honest — the math always favored Texas.

Texas = Lower taxes + Cheaper land + Talent migration + Weather you can golf in year-round.

Goldman’s 800,000-square-foot Victory Park financial campus sits in one of the most connected districts in the state. When it opens, it will bring 5,000 finance and tech jobs to Dallas. Meanwhile, JP Morgan’s Legacy West Plano headquarters anchors a suburban experiment in density that’s become its own North Texas financial district.

Both firms picked Texas for the same three reasons: talent, transportation, and tacos.

The Workforce Influx: More Analysts, More Cappuccinos, More Closings

Tens of thousands of high-salary jobs create their own gravitational pull.

- More bankers = more bars

- More wealth = more wellness centers

- More foot traffic = fewer vacant retail spaces

For the North Texas commercial real estate market, it’s nothing short of a golden run. Office condos once idle are now trading hands. Landlords along the Dallas North Tollway are fielding calls from fintechs, family offices, and private-credit startups relocating to Texas — all looking to follow the mothership.

One Plano developer joked, “We don’t have an office-vacancy problem; we have a parking-space problem.”

The Political Push South

The recent New York City mayoral election of Zohran Mamdani added fuel to the fire. A campaign built on corporate tax reform and business regulation left many Manhattan firms quietly eyeing the exits.

As one executive put it: “Uncertainty is expensive — and Texas feels predictable.”

While New York weighs new surtaxes, Texas continues to court corporate capital through:

- No state income tax

- Low regulatory burden

- Business-friendly policies that transcend politics

It’s not just about lower taxes — it’s about long-term stability, talent access, and pro-growth governance.

The Ripple Effect: New Districts, New Demand

Goldman’s move ignited a Victory Park real-estate renaissance. Nearby towers are renovating. Restaurants are rebranding for six-figure professionals. Multifamily developers are re-mixing units for urban dwellers chasing a Dallas lifestyle — minus the coastal rent.

In Plano and Frisco, the trickle-down looks more like a flood. Corporate expats from Chase and Toyota are buying retail condos and flex industrial spaces — calling themselves first-time commercial investors.

Half of these new landlords used to debug code or trade derivatives. Now they’re modeling cash flow investments in North Texas CRE instead of crypto.

Where Finance Meets Innovation

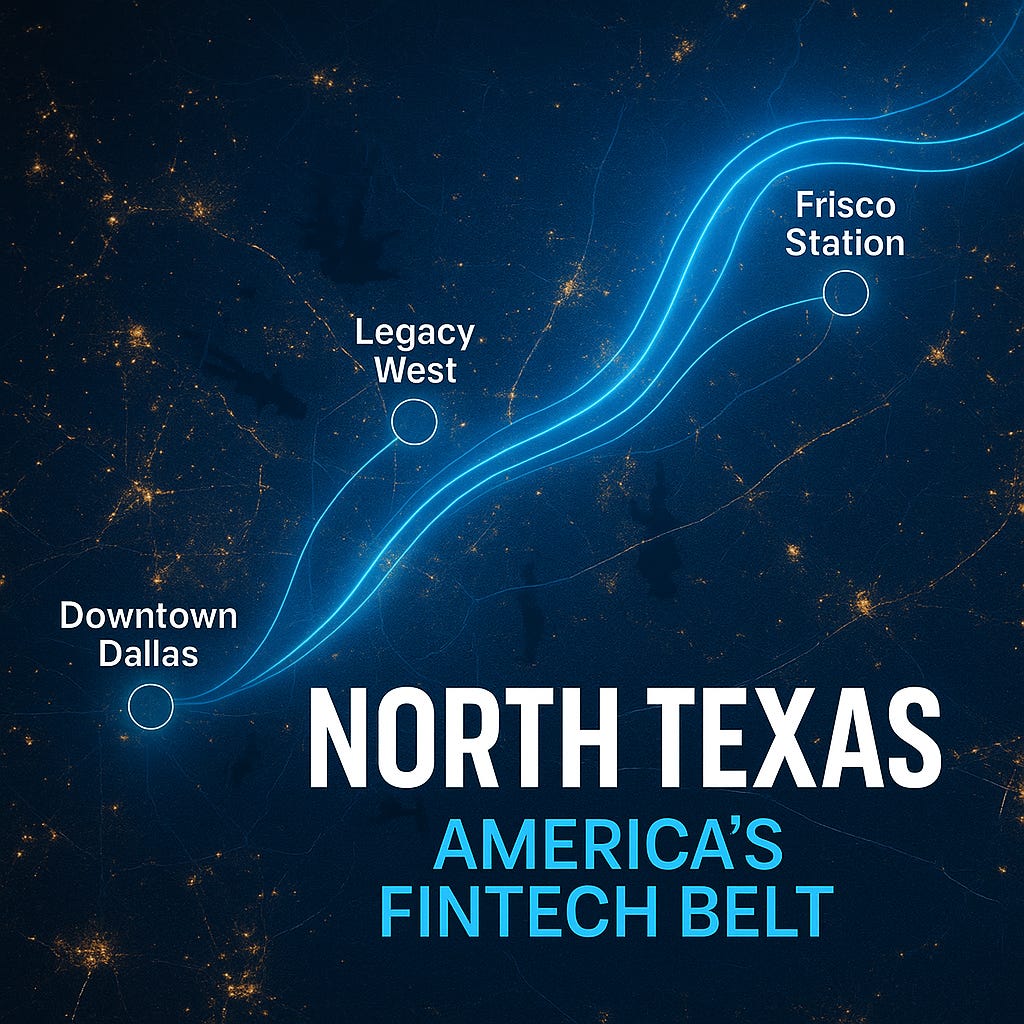

This isn’t coincidence — it’s North Texas economic strategy. The corridor from Downtown Dallas to Frisco Station has quietly evolved into the Fintech Belt of America — a blend of finance, data, and digital infrastructure.

The line-up:

- Legacy West Plano: Chase Bank, Toyota, Frito-Lay

- Frisco Station: Dallas Cowboys HQ, PGA HQ, venture-backed startups

- Richardson Innovation Corridor: Fiber optics and AI data centers powering finance tech

Result? North Texas is no longer the back office — it’s the command center of financial innovation.

Beyond Skylines: Community and Capital

It’s not all spreadsheets and skyscrapers. These institutions bring volunteerism, philanthropy, and mentorship that ripple through Dallas, Denton, and Collin County. Employees join city boards, fund education programs, and invest in local real estate.

For every tower raised, a new nonprofit pops up next door. That’s the Texas version of trickle-down economics — community first, dividends later.

The Future: DFW as America’s Financial Frontier

A decade from now, it’ll sound quaint to call Dallas a “regional market.”

Between the Texas Stock Exchange, the Goldman Sachs Dallas campus, and the rise of AI data centers and energy infrastructure projects, DFW is shaping up to be America’s financial innovation capital.

We’ll still be stuck in traffic on 121 North — coffee in hand — but now that exhaust smells like optimism and freshly signed leases.